Lear Funds is our top choose to the best General gold IRA as it presents cost-free gold and silver guides, a selling price match guarantee, free of charge metallic evaluations, and a massive number of gold metallic tools and analyzers. In addition, it supports rollovers from several other retirement plans.

There won't be any authorities sanctioned rollover or transfer fees to move over an current regular IRA to the important metals IRA account just like a Gold IRA. Having said that, that currently being mentioned, there might be account application fees associated.

You will have to pay for annual fees for the custodian’s assistance and storage, so keep this in mind when weighing the rewards of the extra fees this process entails.

Contact your employer and inquire with regard to the principles of your present 401(k) and no matter if you’re permitted to rollover or transfer to the gold IRA.

One among The key rules that govern gold IRAs is the fact account holders can only lead a confined degree of sources for their IRA per year. The inner Income Service (IRS) has released new, expanded IRA contribution limits with the 2024 tax 12 months:

As soon as that’s all completed, you’ll should keep an eye on your account. Check in consistently to find out how your investments are accomplishing and think about producing an annual rollover in case you’d like to continue getting gold.

Important paper brokerages are likely in order to avoid presenting gold IRA expert services, because they have to have precious metals specialists. You’ll really need to discover the best gold IRA companies that specialize in gold and important metals IRAs and determine which 1 best fulfills your needs.

Rolling above Section of a 401(k) to an IRA can deliver many other advantages. Fiscal planners at Bogart Prosperity highlight the next benefits:

Various expense solutions, which includes mutual resources and gold shares As well as physical gold and silver proof cash and bars

To accomplish a gold find IRA rollover, you may transfer funds from any existing tax-advantaged retirement account, including the following:

The main element distinction between rollovers and transfers is usually that, in the situation of IRA transfers, the distributed revenue by no means touches the IRA holder’s checking account. To learn more regarding how the IRS regulates rollovers, and what the implications of violating them are, have a look at this useful IRS-authored guide to standard IRA rollovers. Or, contemplate looking through this detailed gold IRA FAQ portion straight from Uncle Sam himself.

You will also require a metals vendor who can market you IRS-authorised gold and a protected storage facility to maintain the metal.

For a far more in-depth Assessment of your best custodians out there, examine our assessments of the top see post 10 gold IRA vendors today.

Your most well-liked valuable metals seller plus the nominated custodian will manage all the complex elements of obtaining, promoting, and storing your bullion.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Marques Houston Then & Now!

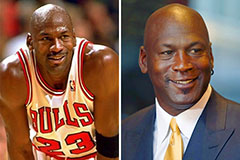

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!